Sukanya Samriddhi Account: Sukanya Samriddhi Yojana is a scheme brought by the Center to provide financial assistance for education and marriage of girls and to give them a better future. How the interest rate of this scheme is calculated. You can withdraw money from this account anytime. Let’s know the details like how to withdraw money.

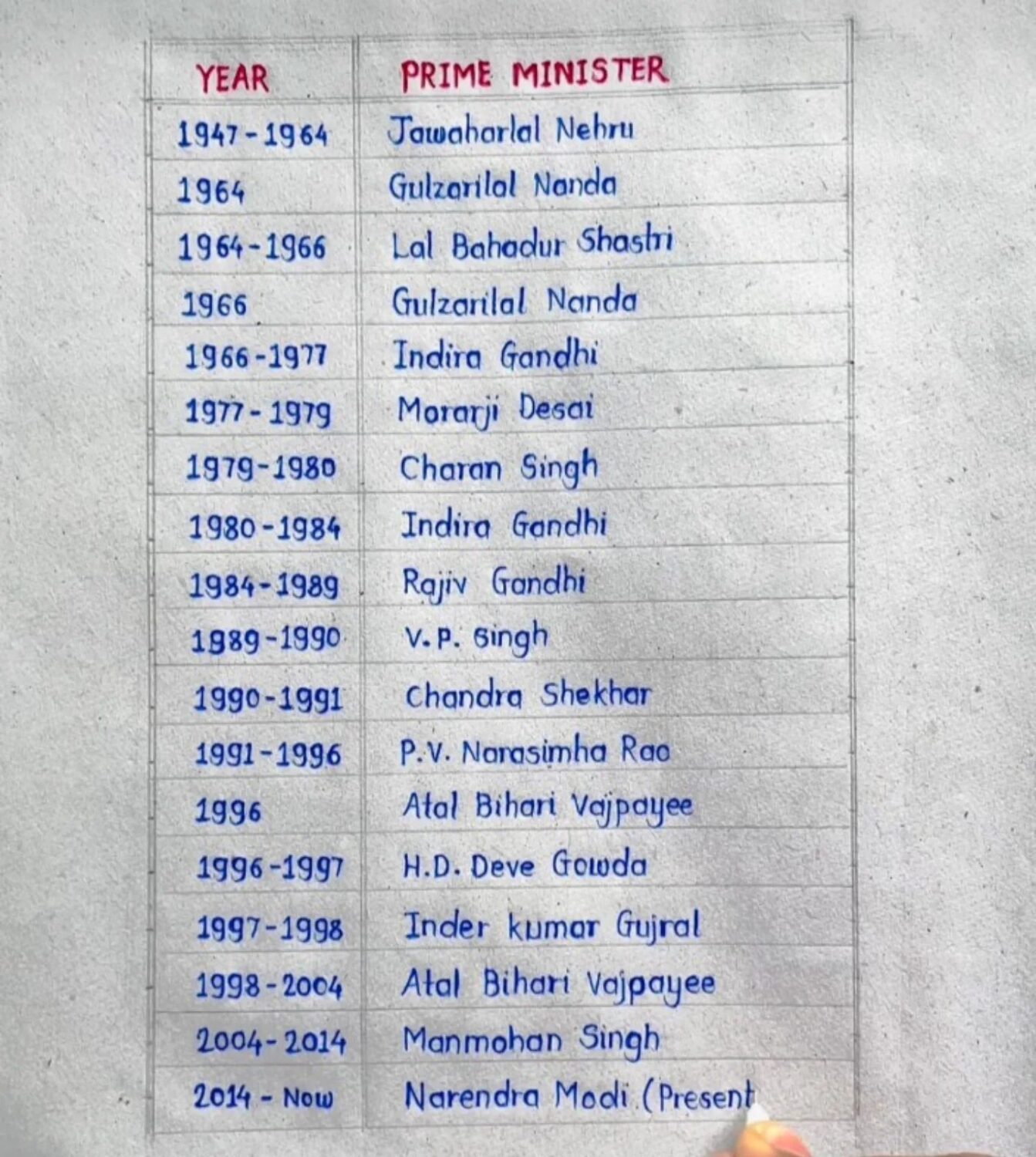

Sukanya Samriddhi Yojana Scheme: As part of the Beti Bachao Beti Padao campaign, the Union government led by Prime Minister Narendra Modi has launched the Sukanya Samriddhi Yojana (SSY). It was introduced on December 2, 2014. This scheme for girls has been well received. Among the small savings schemes, the interest rates of this scheme are the highest after the Senior Citizens Savings Schemes. While 8.20 percent interest is applicable in SCSS, Sukanya Samriddhi currently has 8 percent interest. Every 3 months, the center reviews the interest rates of these schemes. The last change in these interest rates was on September 31. It will then decide on interest rates for the January-March period in late December. Recently, the Post Office has only reviewed five-year recurring deposit interest rates. It has decided to increase its interest rate from 6.50 percent to 6.70 percent. Other schemes kept the interest rates unchanged.

How is Interest Calculated?

Interest is applicable on our deposits in this scheme. The interest is calculated every month and credited to the account once in that financial year by the Centre. Interest on cash is calculated from the lowest balance at the end of the fifth day of every month till the end of that month. Interest accrues at the end of the financial year. At present 8 percent interest will continue.

If The Money Is Not Tied In The Middle?

Sukanya Samriddhi account should be paid for 15 consecutive years. The child has to join this scheme when he is less than ten years old. However, if the money is not paid for any reason, the account will be frozen. Back to Rs. 50 to renew the account. In this scheme every financial year under Section 80c of Income Tax Act Rs. 1.50 lakh tax exemption can be availed.

Can Sukanya Samriddhi Account Be Closed Early?

If the account holder dies.. the account can be closed immediately. The amount you deposit, plus interest, goes to the Guardian. From the time the account holder dies till the account is closed, interest accrues like Post Office Savings Accounts. According to the India Post website.. There are certain conditions to withdraw any cash from SSY in between.

These Are The Rules

Girl should be 18 years old. Or 10th pass.

Up to 50 percent of your account balance can be withdrawn before maturity till the end of that financial year.

This withdrawal can be taken only once. or can be taken in installments. Only once a year is allowed. In this way cash can be withdrawn for a total period of five years.

When can it be closed?

Account can be closed after 21 years of opening. Then maturity ends. The money will be yours along with the total interest. Or if the account holder is over 18 years of age and already married, the account can be closed. This can be done one month before the wedding or 3 months after the wedding.

How to withdraw?

A withdrawal application form has to be filled and submitted at the bank or post office. Identity proof, citizenship proof, residence certificate should be submitted as proof. However, the maximum limit, other charges and fees depend on the amount to be withdrawn at any time. But in this scheme it can be said that there is a good benefit only if you withdraw money for 15 years.